How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

Wiki Article

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Best Guide To Mileagewise - Reconstructing Mileage LogsSome Known Factual Statements About Mileagewise - Reconstructing Mileage Logs Some Known Details About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs - The FactsMileagewise - Reconstructing Mileage Logs for DummiesUnknown Facts About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Timeero's Fastest Distance feature suggests the quickest driving path to your staff members' location. This function improves efficiency and adds to set you back financial savings, making it a necessary asset for services with a mobile labor force.Such an approach to reporting and conformity simplifies the commonly intricate task of managing gas mileage expenditures. There are several advantages connected with utilizing Timeero to track gas mileage. Let's take an appearance at a few of the application's most remarkable features. With a trusted mileage tracking device, like Timeero there is no requirement to fret about unintentionally omitting a date or item of information on timesheets when tax time comes.

Indicators on Mileagewise - Reconstructing Mileage Logs You Should Know

These added confirmation actions will certainly keep the IRS from having a factor to object your gas mileage documents. With accurate mileage tracking modern technology, your workers do not have to make harsh mileage price quotes or even fret concerning mileage cost monitoring.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all car costs (free mileage tracker app). You will require to continue tracking mileage for job also if you're utilizing the real expenditure technique. Keeping mileage records is the only way to separate service and personal miles and give the evidence to the internal revenue service

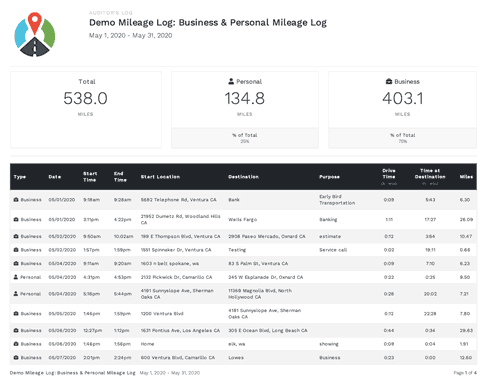

Many gas mileage trackers let you log your trips by hand while computing the distance and compensation amounts for you. Several likewise come with real-time journey monitoring - you need to start the application at the beginning of your journey and stop it when you reach your final destination. These applications log your start and end addresses, and time stamps, in addition to the complete distance and reimbursement quantity.

What Does Mileagewise - Reconstructing Mileage Logs Do?

One of the questions that The IRS states that automobile expenses can be taken into consideration as an "ordinary and necessary" cost in the program of working. This consists of prices such as fuel, maintenance, insurance policy, and the car's devaluation. For these expenses to be taken into consideration deductible, the lorry needs to be used for organization purposes.

A Biased View of Mileagewise - Reconstructing Mileage Logs

In between, vigilantly track all your service trips keeping in mind down the starting and ending readings. For each journey, record the area and company function.This includes the overall company gas mileage and complete gas mileage buildup for the year (business + personal), journey's day, destination, and function. It's important to videotape activities promptly and preserve a contemporaneous driving log outlining day, miles driven, and company purpose. Here's how you can enhance record-keeping for audit purposes: Start with making sure a precise mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

The actual expenditures approach is a different to the conventional mileage rate approach. As opposed to computing your reduction based on a fixed rate per mile, the actual costs method permits you to deduct the real costs associated with utilizing your automobile for business objectives - best mileage tracker app. These costs consist of fuel, maintenance, repair work, insurance coverage, devaluation, and other associated costsHowever, those with significant vehicle-related expenditures or unique problems may gain from the actual expenses approach. Please note choosing S-corp standing can transform this estimation. Eventually, your selected approach ought to align with your certain economic goals and tax situation. visit this site The Standard Mileage Price is a step issued every year by the internal revenue service to establish the insurance deductible expenses of operating a vehicle for service.

Not known Facts About Mileagewise - Reconstructing Mileage Logs

(https://www.4shared.com/u/0-U_xJ8E/tessfagan90.html)Whenever you utilize your car for service journeys, tape the miles took a trip. At the end of the year, once again take down the odometer reading. Determine your total service miles by utilizing your start and end odometer analyses, and your taped service miles. Accurately tracking your precise gas mileage for organization journeys help in corroborating your tax reduction, especially if you decide for the Requirement Mileage approach.

Maintaining track of your gas mileage by hand can need persistance, yet keep in mind, it could save you cash on your tax obligations. Tape the complete gas mileage driven.

Some Known Questions About Mileagewise - Reconstructing Mileage Logs.

And now almost every person makes use of GPS to get about. That means almost everybody can be tracked as they go about their business.Report this wiki page